Data from the US Bureau of Labor Statistics reported Tuesday that the consumer price index showed a minor increase of 0.3% on a monthly basis and 2.7% annually. The core CPI, though, which excludes more volatile sectors like food and energy, was slightly better, with a rise of 0.2% monthly and 2.6% annually. Both indices were 0.1% below expectations. The reaction by the US President Donald Trump was immediate. He has been urging the US Federal Reserve Chair Jerome Powell to cut the interest rates for almost a year and a half, and the CPI data from today gave him new arguments to do so. After continuing to call him ‘too late’ Powell (for not lowering the rates on time), Trump said the Fed Chair should “cut the interest rates, MEANINGFULLY!!!’ Thus, the POTUS kept on pressing Powell after the recent US DOJ actions, which the latter believes were initiated by Trump himself. BREAKING: President Trump calls on Fed Chair Powell to cut interest rates after this morning’s CPI inflation data. “Thank you mister tariff,” Trump adds. pic.twitter.com/XxQ9HApM4x — The Kobeissi Letter (@KobeissiLetter) January 13, 2026 Shortly after the CPI data was released, BTC went from under $92,000 to just over $92,500, before it slipped back down and is now on the offensive again after Trump’s remarks. The current landscape is highly unpredictable and is expected to be even more volatile in the following days, even though BTC has remained relatively stable given the geopolitical unrest. The post Trump Urges Powell to Lower Rates After Favorable CPI Data: How Will BTC’s Price React? appeared first on CryptoPotato .

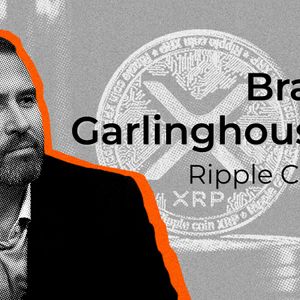

Ripple CEO Heading to Switzerland: Details

Ripple CEO Heading to Switzerland: Details