Taiwanese prosecutors on Monday filed new indictments against Tokyo Electron Taiwan and three people in a growing legal case tied to alleged theft of TSMC trade secrets, according to information released by prosecutors. The defendants include one former TSMC employee surnamed Chen who was already charged last year, a second former TSMC employee also surnamed Chen, and a former Tokyo Electron Taiwan employee surnamed Lu. Prosecutors seek prison terms and higher fines The prosecutors said they are seeking prison sentences for all three defendants, as the first Chen faces a requested term of seven years, the second Chen faces eight years and eight months, and Lu faces one year in prison. Meanwhile, prosecutors are now also seeking an additional T$25 million fine against Tokyo Electron Taiwan. This would come on top of an earlier request filed in December for a fine of up to T$120 million, which equals about $3.8 million. The new fine request followed what prosecutors described as findings from deeper investigative work. After the first Chen was indicted in August, prosecutors charged Tokyo Electron Taiwan with violating both the National Security Act and the Trade Secrets Act. During the expanded investigation, authorities said they found that both men surnamed Chen were suspected of illegally reproducing TSMC core trade secrets. Taiwanese prosecutors also accused Lu of destroying criminal evidence tied to the case. On Monday, prosecutors said investigators found that cloud storage systems linked to Tokyo Electron Taiwan still contained TSMC trade secret data. The discovery played a role in the decision to pursue further indictments. Tokyo Electron previously said its parent company was not indicted and that the case had no impact on its financial results. TSMC addressed the expanded charges in a short statement. The company said the request for a supplementary indictment was based on results from extended investigations related to the trade secret lawsuit it filed in August 2025. A company spokesperson said:- “As the case is now under judicial proceedings, we are unable to provide further details at this time.” TSMC demand stays intense as chip pressure builds globally This comes after Cryptopolitan reported that Nvidia has approached TSMC to increase output of its H200 artificial intelligence chips after strong demand from Chinese technology companies. Orders from Chinese companies for 2026 exceed two million H200 units, while Nvidia currently holds about 700,000 chips in inventory. The additional volume Nvidia plans to request from TSMC has not been disclosed. One person familiar with the talks said Nvidia asked TSMC to begin producing more chips, with work expected to start in the second quarter of 2026. These discussions and the scale of Chinese demand had not been reported previously. Pricing details also emerged. Nvidia has decided which H200 versions it will sell to Chinese clients and has set prices around $27,000 per chip. The situation adds pressure to global AI chip supply, especially as Nvidia balances Chinese demand with tight supply elsewhere. Still though, Beijing has not approved shipments of H200 chips, even after the administration of Donald Trump signed an order allowing exports to China. Market expectations for TSMC on Wall Street remain high. Goldman Sachs raised its TSMC price target to NT$2,330 from NT$1,720 and reiterated a conviction buy rating. Join Bybit now and claim a $50 bonus in minutes

Ripple (XRP) News Today: January 7th

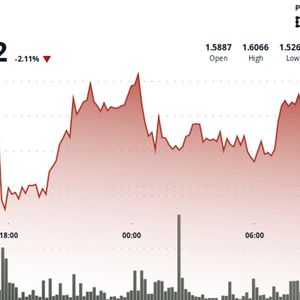

Ripple (XRP) News Today: January 7th Filecoin declines as crypto markets retreat

Filecoin declines as crypto markets retreat