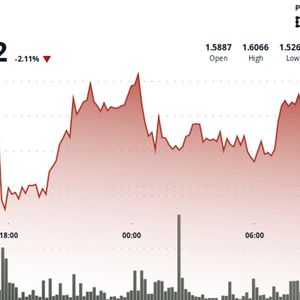

Venezuela may have quietly built a Bitcoin stash of roughly 600,000 to 660,000 BTC. That number would be worth about $56 billion to $67 billion at recent prices, intelligence reports cited by Whale Hunting analysts Bradley Hope and Clara Preve disclose. The said accumulation began around 2018 and involved swaps from gold sales and oil deals priced in stablecoins, then converted to Bitcoin. Some stories tie the chatter to recent political developments in Venezuela, saying the claims have stirred fresh attention on the nation’s finances and on Bitcoin markets. Public Records Tell A Different Story Based on reports from public blockchain trackers and treasury listings, the picture is far less dramatic. Official on-chain wallets linked to Venezuela’s government show about 240 BTC — roughly $22 million at current rates. How The Numbers Were Said To Work Reports that pushed the big number mentioned several methods of accumulation. Gold sales from state mining areas were named. Oil shipments priced in USDT or other crypto were mentioned too. Some accounts also suggest seized mining equipment and opaque trading channels were used to move value into Bitcoin over years. If any of that is true, then large sums could be off the books and hard to trace. Market Reaction And Political Buzz Bitcoin’s price has been sensitive to the story. Traders watched moves above $92,000 closely as the rumor spread. Some headlines linked the claims to geopolitical tensions and to questions about whether foreign authorities could seize or freeze any such reserve if it existed. Reports note that such a seizure would carry legal and diplomatic complications. US President Donald Trump’s recent comments on regional security further stoked interest in how geopolitical events and crypto markets can intersect. Why Skepticism Is Still Needed Investigative limits matter. Blockchain data is public, but wallets can be obfuscated through mixers, custodial services, or private keys held across many accounts. That makes absolute proof difficult without cooperation from those who control the coins or from an audited disclosure. Until verifiable custody records, independent audits, or clear on-chain links are produced, the numbers above should be read as unconfirmed claims rather than settled fact. Huge If True, Unproven Now Based on reports and on public trackers, Venezuela’s official, proven Bitcoin holdings remain small compared with the headline figures. The 600,000–660,000 BTC claim is dramatic; it would reshape market math if proven. For now, it is a high-impact rumor that needs concrete proof. Maduro’s Capture US forces recently carried out an operation targeting Venezuelan President Nicolás Maduro, heightening geopolitical tensions in the region. Reports suggest the move has renewed interest in Venezuela’s alleged Bitcoin holdings and oil, with analysts watching closely for any impact on global crypto markets. The full consequences of the raid and Maduro’s capture are still unfolding. Featured image from Gemini, chart from TradingView

Ripple (XRP) News Today: January 7th

Ripple (XRP) News Today: January 7th Filecoin declines as crypto markets retreat

Filecoin declines as crypto markets retreat