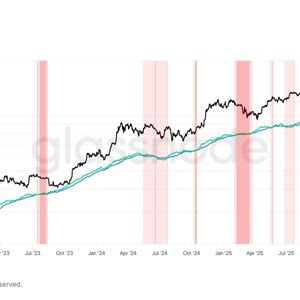

Bitcoin Holders Start Selling at a Loss — Could a Major Run Be Near? Bitcoin is displaying patterns that have historically preceded major market moves. Analyst Diana notes that BTC holders are now realizing losses , a classic signal of peak fear and potential smart-money accumulation. Well, selling at a loss happens when investors offload assets below their purchase price. While it may seem negative, it often signals a potential market rebound because weaker hands exit, creating opportunities for savvy investors to accumulate at discounted levels. Data shows this pattern last appeared in September 2023, with Bitcoin’s current price being $88,266 per CoinCodex data. Notably, BTC recently dipped below $88,000 following $60 million in long liquidations, as shutdown fears and Trump tariff concerns pressure the market. Diana highlighted a classic market setup where mass loss realization signals fear, but smart investors see opportunity. Current trends suggest Bitcoin may be nearing this inflection point. Historically, phases of widespread selling at a loss often precede strong bullish momentum, creating potential conditions for the next rally. Current losses are driven by market volatility, regulatory uncertainty, and macroeconomic pressures, prompting short-term holders to exit. Yet these conditions often draw institutional investors who see Bitcoin’s long-term potential. For retail investors, this period underscores the value of patience, panic selling risks missing the next upswing, while strategic accumulation can position one for significant future gains. Why does this matter? Well, Bitcoin is navigating a classic market cycle since realized losses are spiking, fear is high, and smart money is quietly buying. Historically, such conditions often precede major rallies, as seen after September 2023’s breakout. CryptoQuant’s NRPL shows losses turning sharply negative, with $4.5B in recent realized losses, while CME gaps target $89,350 and $93,000, hints that BTC could be gearing up for its next bullish surge. The coming weeks may determine if panic selling gives way to renewed upward momentum. Conclusion The recent surge of Bitcoin holders selling at a loss signals more than fear, it may hint at opportunity. History shows such sell-offs often precede major rallies, as savvy investors accumulate while weaker hands exit. Therefore, this could mark the start of the next bullish phase, reminiscent of September 2023 as BTC approaches a pivotal moment in its cycle.

NBA Legend Pippen Warns: 'Be Like Satoshi'

NBA Legend Pippen Warns: 'Be Like Satoshi'